I always smile when I’m flying somewhere and I see the flight attendant begin his/her safety presentation. Inevitably, they get to the part where they put on the oxygen masks and remind us that if we’re traveling with small children to put our own masks on first.

And while thankfully I don’t look to put an oxygen mask on in my every day life, I always smile at the amazing metaphor the in-flight oxygen mask is for our lives.

Because if you’re not putting your own mask on first, how are you going to be at your best to support others? How will you be able to create abundance in your life?

As July came to a close and August began this year, quite honestly I was highly emotional and wanted to rest and be quiet. It had been a long 18 months of traveling and personal growth and my soul was crying out for a break. I had reached “that point” that most of us know about…the one where your mind is foggy and you don’t know what direction you’re headed in and you want to take naps all day.

Generally speaking, I do a good job of taking care of myself and it snuck up on me and I ended up exhausted without much of a warning. This time it was exhausted in a different way though – years ago I would experience physical and mental exhaustion after working countless 70-80 hour weeks, and this time it was more emotional exhaustion. I felt directionless and uncertain…so many things felt like they were changing. I was also concerned about how long this phase was going to last since I really don’t enjoy drifting along without energy or a sense of drive. The emotional exhaustion was impacting my body, my confidence, and my desire to spend time with others (I was so tired and my introvert just wanted to hide and chill out!).

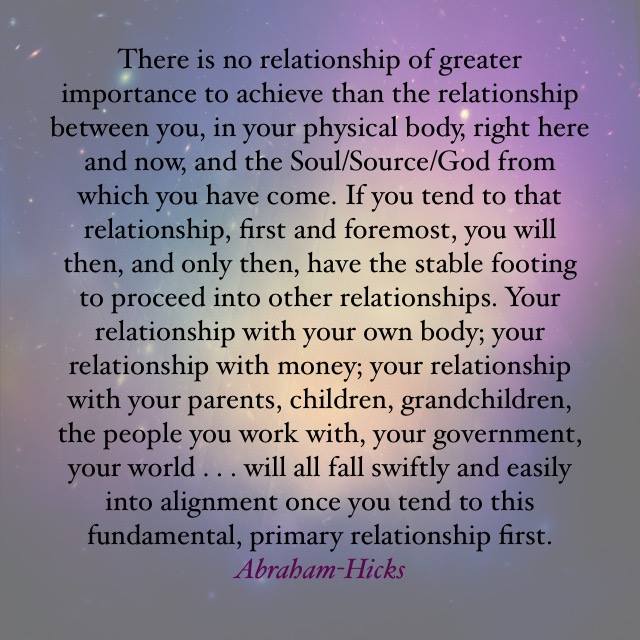

And then after surrendering to the soul whispers to “rest,” the tide eventually turned. With several weeks of resting with some light work added in here and there (the minimal amount necessary to keep things moving), I started to feel stronger. And just the other day, I saw this:

All of a sudden it clicked. This time had been created for me to reconnect with my intuition. As the quote shares, when I connect with that relationship first and foremost, only then can I powerfully step into other relationships including my relationship with money. For too long, I had ignored the whispers to take my self care to the next level (i.e. healthier eating, increased meditation, etc.), and instead had insisted on pushing forward. Even if I didn’t want to admit it, it was indeed impacting all of my other relationships and my ability to be present.

So, I’ll ask you this after hearing my story – can you hear the whispers in your own life to slow down and listen? Check in with yourself, and see what, if any, course corrections are necessary to fuel you to build a strong and healthy relationship with your money and to step into your best life. Because without fuel in your gas tank, getting from point “A” to point “B” and creating abundance in your life is going to be all that much harder.

Sometimes life shows up with lessons that we don’t understand and perhaps that we don’t necessarily want to learn. I didn’t want to slow down and take a month-long rest, and yet somehow my soul knew it was exactly what I needed in order to be prepared for the next part of my journey.

Are you putting on your own oxygen mask first?

Are you present enough to see the signs taking place around you every day?

Are you taking yourself for granted as the foundational pillar upon which the rest of your life will be created?

Don’t wait until it’s too late…take some time today to stop, breathe, and listen.